As a college student, I have often found myself getting concerned about my future of paying off the loans I have incurred. This concern only magnifies when I consider other plans for my future, such as the possibility of buying a house, getting married, and starting a family. Though I will likely have other hurdles to clear first which will assist me in preparing for these plans, I have often thought about how long it will take me to pay down my loans. As it turns out, I’m not alone in the concern. USA Today published an article claiming that many young Americans, namely Millennials, are delaying marriage due to student loan debt. USA Today bases this on a study from Lendkey, a cloud platform which allows lenders and borrowers to match online in an attempt to “create the most transparent,accessible and low-cost borrowing options in online lending” (Lendkey’s About Us Page). The article claims that “about one-third of respondents between ages 18 and 34 say they might postpone marriage” in order to pay off student loans. Setting aside that the title of the USA Today article makes it seem as though most or all Millennials are doing this and not merely one-third, the fact I will be checking is whether a significant portion of young people are indeed putting off getting married due to student loan debt.

Checking for previous work proved to be difficult for this. DuckDuckGo searches proved unfruitful, as searching various versions of “millennial marriage debt”, “millennial loans marriage”, “millennial student loans marriage”, “millennial student debt marriage”, “millennial marriage”, “millennial loans”, and even things like “Lendkey student loans” and “Lendkey millennials”. None of these searches yielded pages from Politifact, Snopes, or FactCheck.org which gave figures on either Millennials’ student loans or their marital status.

The Wikipedia page for Millennials says under the Social Tendencies section that Millennials “the first in the modern era to have higher levels of student loan debt and unemployment” than previous generations, that projected trends in 2014 suggested “millennials will have a lower marriage rate compared to previous generations”, and that Millennials often “delay some activities considered rites of passage of adulthood” such as leaving their parents’ home and living with a romantic partner. The Millennials page did cite a 2014 article from CNN Money discussing Millennials’ trends with marriage, and this article does also claim “that college graduates marry later so they are better able to ride out poor economic times just after they finish school”, citing an Urban Institute report. It is worth noting that CNN’s hyperlink on “college graduates” leads to a page on https://buzz.money.cnn.com/, which seems to be a site made with WordPress. The particular page it leads to only discusses a book which encourages graduating women to lean into their careers and does not actually reference Millennials, marriage, or student loan debt. Overall, checking previous work does seem to suggest that Millennials are getting married less, that they have more student loan debt, and that they are delaying milestones of adulthood, but there is little there to prove too much correlation.

With previous work leading to little verification of the claim, I then went upstream on the USA Today article. I first went back to the USA Today article and followed a link to the page where Lendkey discusses their findings. Their findings match the figures cited in the USA Today article, claiming that one third of respondents to their survey between 18-34 “said they might postpone marriage — or had already done so — until student debt is paid off”. The bottom of this page discusses the methodology of this study, saying “All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,037 adults who have ever attended college. Fieldwork was undertaken between December 9-13, 2019. The survey was carried out online.” The survey had just over 1000 respondents across all age brackets and does not specify how many of them were Millennials. Thus, while one third of their Millennial respondents might be postponing marriage, if their actual proportion of Millennial respondents is small then it might not be representative of the actual population of Millennials.

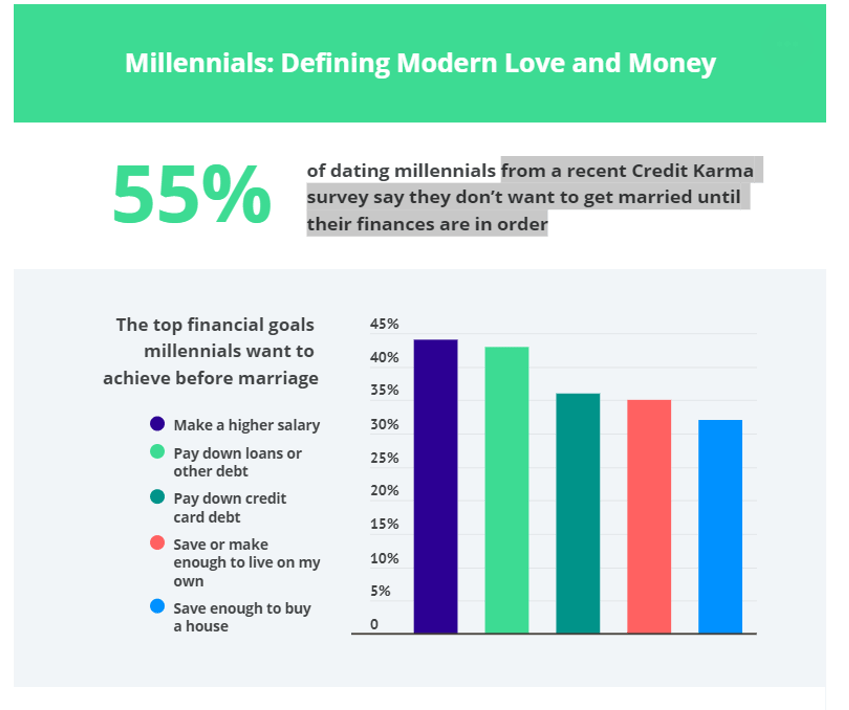

The USA today article does also provide the link to a separate study conducted by Qualtrics on behalf of Credit Karma among 1,036 American Millennials which suggests that “55% of dating Millennials from a recent Credit Karma survey say they don’t want to get married until their finances are in order” and that 43% of these Millennials list paying down a loan or debt as one of the financial goals they want to achieve. This survey looked at a slightly more relevant demographic, “adults aged 25-38 in a relationship”, which combined with the defined American base makes these findings slightly more reliable.

Reading laterally proved difficult in this case, as the Lendkey study was not performed by a peer-reviewed journal. This poses an issue from the start, as it means that their results may not have been thoroughly reviewed by people who might be in relevant fields such as population scientists, sociologists, or even economists. The lack of support from within the field consequently makes it difficult to fully depend on the Lendkey study from a scientific standpoint. The Lendkey study was carried out by YouGov Plc., which is, according to Google, “a British international Internet-based market research and data analytics firm, headquartered in the UK, with operations in Europe, North America, the Middle East and Asia-Pacific”.

At first I thought that their base in the UK might get in the way of obtaining American respondents and that there might be differences between British and American millennials in marriage trends. This concern might have been misplaced, as YouGov claims to draw from an online panel of 8 million panellists across 38 countries covering the UK, USA, Europe, the Nordics, the Middle East and Asia Pacific” (YouGov, “Our Panel”). YouGov also claims that this group consists of “all ages, socio-economic groups and other demographic types which allows [them] to create nationally representative online samples and access hard to reach groups” (“Our Panel”). Thus it is safe to assume that YouGov is capable of constructing a representative sample. Searching google with the search syntax “yougov.plc -site:today.yougov.com -site:yougov.co.uk -site:yougov.com” to find information on YouGov from outside YouGov itself, I was unable to find any information suggesting YouGov’s unreliability or past flaws in its methods, and sites like Reuters and Bloomberg depict the company as thriving and growing in terms of economic measures like GDP and stocks. Though these measures may simply indicate that their business is booming, it is likely that their business would not be increasing if their work were subpar or inaccurate.

Reading laterally on Qualtrics, who performed the Credit Karma study, there seems to be a bit more evidence of reliability. The Qualtrics Wikipedia page notes that data from Qualtrics is cited in several academic journals, and the associated citations lead to a wide array of journals, including ones in the fields of engineering, business, communications, and marketing. This indicates that the findings from Qualtrics are considered generally reliable across a variety of fields.

Overall, while there does not seem to be much previous work, there are multiple studies which suggest that Millennials are getting married less, that they do have large amounts of student debt, and that a significant portion (though perhaps not a majority) are delaying marriage until their finances improve and loans are paid down or off entirely. These studies are performed on behalf of various lending or credit services, which may constitute some conflict of interest, but they delegated the studies to market research and statistics firms which are seen as viable and reliable gatherers of information. Thus, while I would hesitate to say that this trend represents the entirety of the Millennial generation due to possible issues like the sample size of the studies, it does appear that this claim is at least partially factual, as it is agreed upon by people who deal with loans and have surveyed Millennials that a decent portion of Millennials do in fact put off marriage due to debt, which often takes the form of student loan debt due to the age of this demographic. This serves as a bit of a wake-up call for me. Though I had not planned on getting married particularly soon, I would like for student debt to not be a factor by the time I do, so it seems I need to start putting more energy into financial and career planning so that I can get rid of my own debt as soon as possible and get on with my life on my own terms.